The government announces the collapse of another bank nearly every week; sometimes 3 or 4. According to Bill Bartmann, we are amid the worst banking crisis since the Savings & Loan crisis nearly twenty years ago.

Over 75 banks have failed already this year, nearly three times the total last year. Thanks to the Federal Deposit Insurance Corporation, depositors are rarely affected.

Bill Bartmann believes more than 1,000 more banks will fail over the next eighteen months. These failures will cost the FDIC nearly $70 billion through the year 2013 with most of that amount coming by next year.

How does a bank fail?

Though bank closures are usually announced on Friday after the close of business, it is a very lengthy process. Simply put, the government closes a bank when it cannot meet its obligations to depositors and others. Bank failures have increased dramatically as the economic downturn has forced mortgage holders and business owners to default on loans.

The process begins with troubled lenders being placed on the FDIC watch list. At this point, the bank is losing capital at a disturbing rate. There are currently over 300 bans on the watch list; a huge increase from only 50 at the end of 2006.

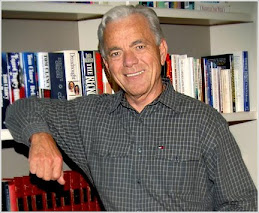

Bill Bartmann knew about the recent Colonial Bank failure nearly three months before it was announced. “We were offered an opportunity to look at the assets and kick the tires on this used car. We passed on it because it didn’t fit our appetite,” said Bartmann. During the S&L crisis in the late 1980s, Bill Bartmann bought assets from more than 800 failed banks.

When a bank fails, the FDIC attempts to find a suitor for the assets. Often, the agency will hold them and try to unload them later through contractors such as DebtX and First Financial Network or through other structured vehicles.

The FDIC does not actually close the bank; once they are done shopping the bank’s assets, the institution can be closed by the Office of Thrift Supervision, the Office of the Comptroller of the Currency or a state regulator.

Once a bank closes, typically on a Friday after business hours, the FDIC works with the institution to ensure the doors open Monday for depositors to access their money. This is a very busy weekend for the FDIC; they have to get familiar with the operations, work with employees to ensure pay and health benefits, pair up the human resources and IT teams and transfer the account records. “The customer in most cases sees it as a seamless transition, said Bill Bartmann. The next day the customer can go to the bank and his deposits are safe and exactly where they were the day before.”

More Failures to come

Since the FDIC was formed 75 years ago, no depositor has lost money on insured deposits. The agency recently increased their insurance to cover amounts up to $250,000. “That’s a remarkable history given the chaos our country ahs been through,” said Bartmann.

Bill Bartmann credits the FDIC Chairman Sheila Bair with the agency’s performance during the current crisis. “I’ve been married for 36 years. If I wasn’t married to my present wife, I would chase this woman down,” said Bill Bartmann. “She has more courage than any chair of the FDIC to date.”

The FDIC employs 7,000 people in more than 80 field offices; they will likely stay busy in the months ahead as the next wave of bank failures is expected to hit community banks. Bill Bartmann expects to see many more banks fail as commercial real estate loans default and local shops we drive by every day go under.

Bill Bartmann is the author of Bailout Riches: How Everyday Investors Can Make a Fortune Buying Bad Loans for Pennies on the Dollar. The book recently became an Amazon #1 world-wide best-seller. Bill Bartmann has been in every major newspaper and is frequently interviewed on television and radio.

Wednesday, November 4, 2009

Bill Bartmann in the News: Bill Bartmann Discusses Bank Failures

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment